Circular 08/2026/TT-BTC is considered the final piece in the legal framework, directly addressing technical recommendations from FTSE Russell and satisfying the qualitative criteria of the two biggest barriers frequently mentioned by FTSE Russell: “Payment cycle” and “Account opening procedures”…

As reported by VnEconomy, Circular 08/2026/TT-BTC, issued on February 3, 2026, serves as a key legal document to finalize the technical conditions for upgrading the market status.

The circular focuses on three main pillars, clearly defining the Global Brokerage Mechanism: This is a breakthrough in administrative procedures, allowing foreign investors to conduct transactions through international brokerage institutions. This mechanism removes the barrier of having to open a direct account in Vietnam, simplifying the entry process for large capital flows.

According to Mirae Asset Securities’ assessment, Circular 08/2026/TT-BTC and the completed legal framework by early 2026 provide a foundation for the market to demonstrate stability.

This is a necessary condition for FTSE Russell’s review in March 2026 and the official upgrade to Secondary Emerging Market (September 2026). The market is expected to attract approximately $1 billion from passive investment funds after FTSE Russell includes Vietnam in its Secondary Emerging Markets Index on September 21, 2026.

Simultaneously, an event organized by the State Securities Commission in collaboration with the International Finance Corporation (IFC) and the Swiss Federal Department for Economic Affairs (SECO) announced the Vietnam Corporate Governance Code 2026 (VNCG Code 2026).

The application of the VNCG Code 2026 Corporate Governance Principles, in line with international practices, enhances transparency and supports the goal of upgrading the Vietnamese stock market. In particular, integrating ESG into the core strategy aims to attract sustainable investment flows and align with global trends.

Roadmap to the 2030 goal: The potential for revaluation after the upgrade stems from Vietnam’s efforts to develop a sustainable financial market, considering criteria such as market structure, liquidity, information transparency, and ease of access for foreign investors. Furthermore, Vietnam is continuing its efforts to meet the criteria for upgrading to MSCI’s emerging market status (including FOL, CCP, and FX markets). The 2030 FTSE Russell target is to become a high-level emerging market.

The VN-Index closed on February 4th at 1791.43, corresponding to a current P/E ratio of 16 times. The current valuation is lower than the long-term average of 17 times, and coupled with a projected EPS growth of approximately 20% in 2026 (our base scenario), this indicates that the market’s growth potential remains attractive.

According to Mirae Asset, the breakthrough prospects of the Vietnamese stock market stem from the synergy of three factors: the potential for revaluation after the upgrade; increased market liquidity; and recovering business confidence.

Sharing the same view, KBSV Securities emphasized that Circular 08/2026/TT-BTC is considered the final piece in the legal framework, directly addressing the technical recommendations from FTSE Russell: Satisfying FTSE’s qualitative criteria: The two biggest obstacles frequently mentioned by FTSE Russell are “Payment cycle” and “Account opening procedures”.

The widespread adoption of NPF and the Global Broker mechanism has directly addressed these concerns. This has helped Vietnam approach Secondary Emerging Market standards in terms of both operational efficiency and market openness.

The March 2026 review is a crucial period for FTSE Russell to assess actual reforms before making a final decision. Circular 08 provides a solid legal basis for international organizations to conduct trials and evaluate the actual operation of the system.

With the legal framework finalized in early 2026, the market has ample time to demonstrate the stability of the new system. It is highly likely that Vietnam will be officially upgraded by FTSE Russell in September 2026, leading to a significant increase in both active and passive capital flows.

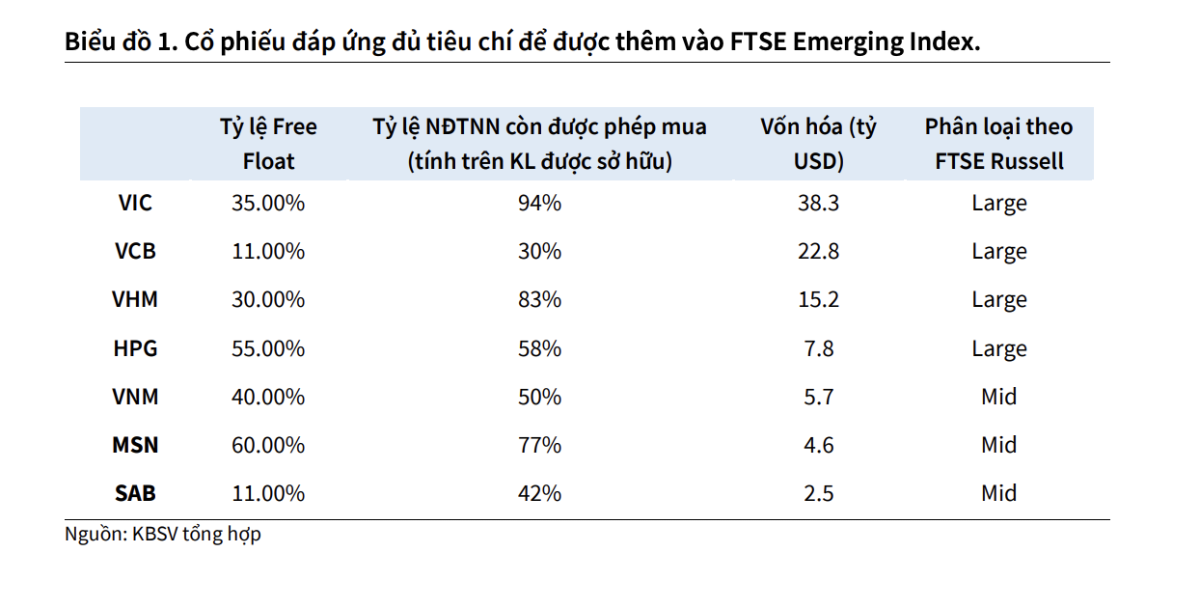

FTSE Russell has released a list of 28 stocks (from Small to Largecap) eligible for inclusion in the FTSE Global All Cap Index based on data up to the end of 2024. Although the final results may change when the official announcement takes effect in September 2026, based on quantitative criteria, KBSV believes that stocks classified as Largecap and Midcap will almost certainly continue to be included in the index in the next period. Changes in the classification of Smallcap stocks will be more significant due to fluctuations in market capitalization and liquidity.

Source: vneconomy.vn