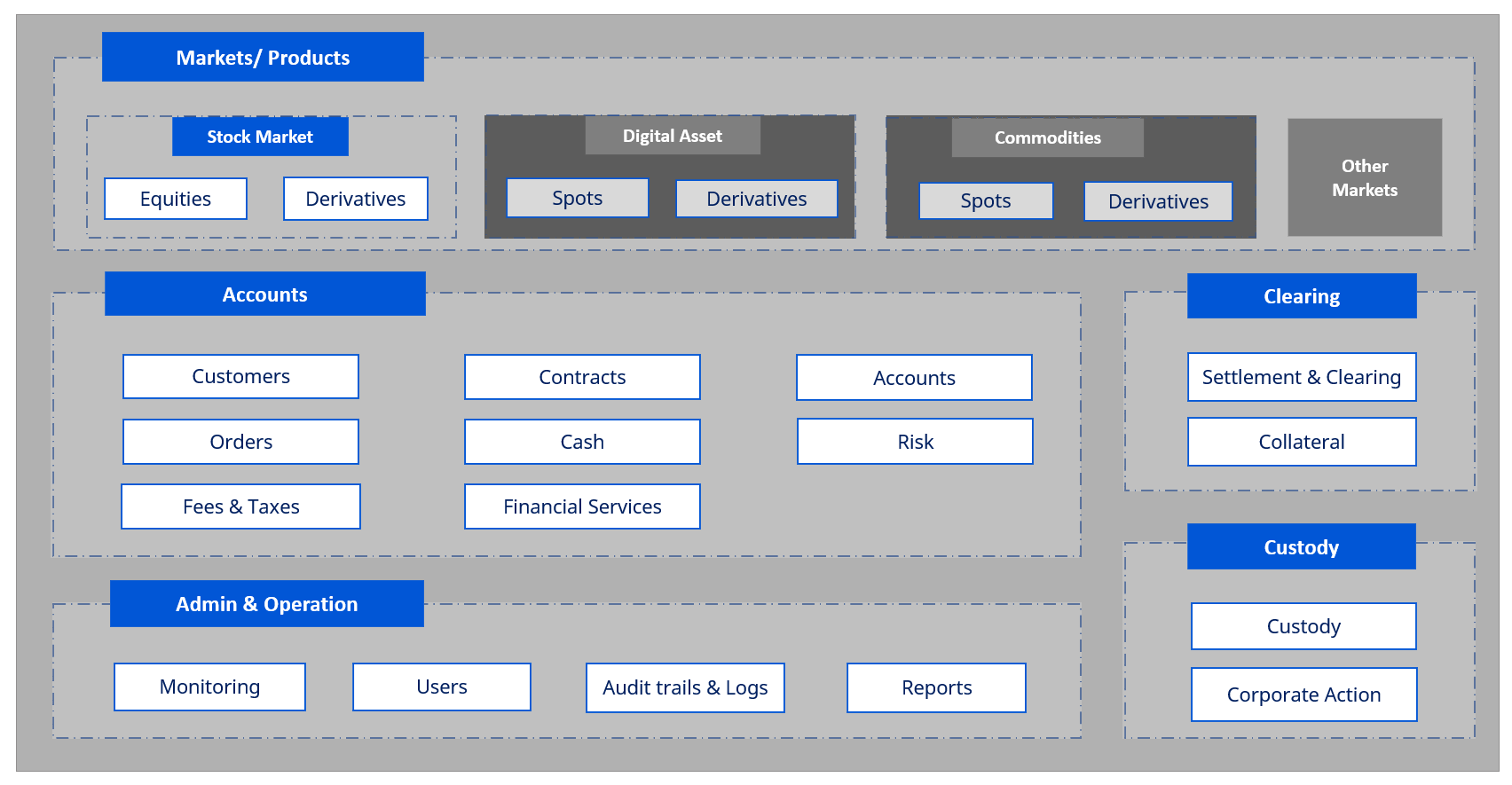

Overall main components in the set

Core Back Office System

Core Back Office System

Product Management, Capital Management, and Internal Control

Product Management & Trading Policies

Configure product types: stocks, bonds, derivatives, warrants, ETFs, repos, margin trading, etc.

Assign fee policies, terms, limits, and capital utilization ratios for each product.

Classify products by customer group (VIP, individual, institutional).

Manage the product lifecycle: creation – selling – cessation of sales – history storage.

Capital Risk Management & Internal Control

Develop an early warning system for exceeding capital limits.

Monitor capital utilization rates for each product type.

Tracking and recording all user actions (audit trail).

Manage multi-level approval processes, dynamic access control by department and risk level.

Generate reports for internal audits, inspections, and compliance reports for the Securities Commission.

Capital Management

Monitor the company's total capital and allocate it to each product/business operation.

Manage capital usage limits for margin, repo, advances, proprietary trading, etc.

Update available capital status in real time.

Alert for liquidity shortages and automatically suggest allocation.

Connect with banking and accounting systems to synchronize balances and total cash flow.

Core Back Office System

Customer, Contract, and Account Management

Customer Information Management

Manage complete customer identification information for individuals and organizations (CIF).

Manage information of authorized persons and related parties.

Integrate electronic eKYC process, multi-channel authentication (OTP, facial recognition, digital signature...).

Classify customers by group, transaction type, risk level, income source, etc.

Store electronic records, related documents and information change history.

Contract Management

Supports signing, storing, and tracking various types of contracts: account opening, margin contracts, trading authorizations, etc.

Integrated electronic signature (eSign) and electronic contracts (eContract) allowing customers to sign and open contracts online remotely.

Monitors contract validity status, alerts for upcoming contract expirations, and automatically updates new terms.

Ensures full compliance with legal requirements and easy access when needed.

Account Management

Create and manage various account types: regular accounts, margin accounts, trust accounts, etc.

Allows opening sub-accounts.

Monitor account status (active/inactive), limits, and links with banks/custody.

Manage account links with traders/brokers for sales sharing and customer service.

Core Back Office System

Manage Deposits, Fees, and Taxes

Deposit Management

Monitor cash balances by account, customer, and branch.

Automatically update cash flow from the front-end system or linked banks.

Manage cash freeze operations (deposits, advances, taxes, etc.).

Support internal and interbank money transfers, accounting for proceeds from securities sales.

Low balance alerts, control of unusual cash flow, T+ tracking.

Fee Management

Set up flexible fee schedules based on product, customer type, and transaction channel

Automatically calculate transaction fees, custody fees, advance fees, margin fees, repo fees, etc.

Integrate incentive and discount policies based on customer groups or transaction volume.

Trackate fee accounts receivable, collected status – uncollected – free – refunded.

Integrate with Brokerage and Accounting management systems for revenue reconciliation and recording.

Tax Management

Automatically calculate personal income tax (PIT) for stock and bond sales, OTC transfers, etc.

Calculate and deduct tax from cash dividends and stock dividends (if any).

Track tax obligations for each customer and each transaction.

Integrate tax reports and PIT tax statements by period/month/year.

Connect to the electronic invoice system for quick tax document issuance.

Core Back Office System

Financial Services Management

Margin Loan Management

Manage loan packages with loan ratios and interest rates based on transaction types and customer categories.

Calculate purchasing power, margin ratio, and loan limit for each account.

Monitor real-time collateral value, loan interest, and margin status.

Warnings for breach of safety thresholds: warnings – margin call – force sell.

Automatically process loan settlements when customers deposit funds or sell securities.

Advance Payment

Automatically advance payment when a customer makes a purchase or withdrawal. Transparent to the customer throughout the process.

Calculates the order value eligible for advance payment.

Allows partial or full advance payments based on parameters set according to company policy.

Manages advance payment fees, terms, and automatic reimbursement when funds are received.

Pledges and Guarantees

Record and value pledged securities based on market data.

Manage loan contracts on pledged assets used as collateral, interest rates, limits, and loan terms.

Manage guarantee files: subject, type, value, and term.

Monitor guarantee fees, collateral, and validity status.

Warn when the guarantee is about to expire or exceeds the limit.

Core Back Office System

Depository Management

Account Custody Management

Open and manage custody accounts for each client.

Monitor securities status: in custody, frozen, awaiting transfer, etc.

Manage ownership by asset type: stocks, bonds, warrants, ETFs, etc.

Synchronize securities balances with the Vietnam Securities Depository (VSD) via file/API connection.

Execute Transactions

Censorship transactions comply with regulations and support maximum automation.

Monitor the status of each transaction execution request: initiation → approval → submission to VSD → completion.

Connect with the VSD custody system to send and receive messages and compare the results of ongoing transactions.

Connect and synchronize data with VSD

Connect with VSD to ensure that the securities company's custody data completely matches the data at the Central Depository.

Automatically compare securities status by session or periodically.

Detect and warn of discrepancies between the internal system and VSD.

Export custody reports & electronic documents for inspection/accounting purposes.

Core Back Office System

Exercise rights

Automatically receive and update rights events

Synchronize event data from the Vietnam Securities Depository (VSD) and the Stock Exchange: dividend distribution, rights issue, stock bonus, additional share issuance, etc.

Accurately update the record date, final registration date, ratio, type of rights, etc.

Send notifications & support registration for exercising rights

Automatically send notifications to each investor eligible to exercise rights.

Support online registration for purchase rights, dividends, and receiving shares via the trading system or mobile app.

Record and confirm registrations within the specified timeframe, track customer interaction history.

Automatic Allocation & Processing of Rights

Accurately calculates the amount to be received/expected to be allocated: cash dividends, stock dividends, subscription rights, etc.

Supports collection of subscription rights and allocation of corresponding securities

Automatically updates assets after the exercise date (stock split, cash addition, etc.).

Reconciliation and reporting according to VSD standards

Send/receive files for exercising rights from VSD, automatically reconcile allocation results and securities balances.

Monitor the processing status of each event for each securities code and customer.

Core Back Office System

Offsetting, settlement

Clearing & Settlement Management

Accommodates clearing models in the form of Bilateral, Multilateral, or Central Partner (CCP) models for each exchange and market.

Supports multiple settlement models (gross/net, DvP model BIS 1/2/3). Flexible settlement cycle.

Automatically receives settlement obligations from VSD on each trading day (T+1, T+2…).

Allocates obligations to each customer account or group of accounts.

Clearing & Settlement

Automate the entire clearing & settlement process – reduce reliance on manual processes.

Ensure accuracy and timeliness in all transactions – avoid breaches of obligation.

Reconcile transactions and payment obligations.

Manage risks & monitor obligation status.

Connectivity and Operational Monitoring

Full integration with banks and VSD

Aggregates deposit/withdrawal obligations and payment of money and securities by customer.

Dashboard monitors payment status, risks, and collateral assets across the entire system.

Automatically sends reports to the Securities Commission, Exchange, VSD, and internal management departments.

Integrated real-time alerts for margin or payment obligation violations.